21+ calculate irr python

Web numpyirr values. This financial function helps user to compute IRR Value ie.

2011 Guidelines For Application Of The Petroleum Resources Management System Pdf Oil Reserves Industries

Web As we noted earlier one approach to calculate an annual IRR is to aggregate the cash flows to form an annualized value.

. Web A step-by-step guide on how to build a DCF model discounted cash flow to calculate NPV IRR Payback Period and Multiple Invested Capital MOIC using. The cash flows for projects 1 and 2 are available as cf_project1. As a module it currently provides straightforward and easy to.

In the same way. Average periodically compounded rate of return. Similarly you can check irr using the npv function.

It primarily serves as a. This is the average periodically compounded rate of return that gives a net present value of 00. With Python and NumPy however we can.

Web You can use a diferent optimization method which allows the constraint rate -100 or rate 0 or use a bounded method eg. Web Up to 25 cash back In this exercise you will calculate the internal rate of return for each project using npirr values. Deprecated since version 118.

Web numpyirrvalues source Return the Internal Rate of Return IRR. This is the average periodically compounded rate of return that gives a net present value of. Web Internal Rate of Return on a set of cashflows sometimes positive and sometimes negative resulting from an initial investment import numpy as np t0 -500.

For details see NEP 32 1. Web Up to 25 cash back Comparing project NPV with IRR. Web A few financial functions for quick analysis of an investment opportunity and a series of associated cashflows.

Web The result can be checked with the xnpv function. Here finance_rate 34 and. Web numpyirrvalues source Return the Internal Rate of Return IRR.

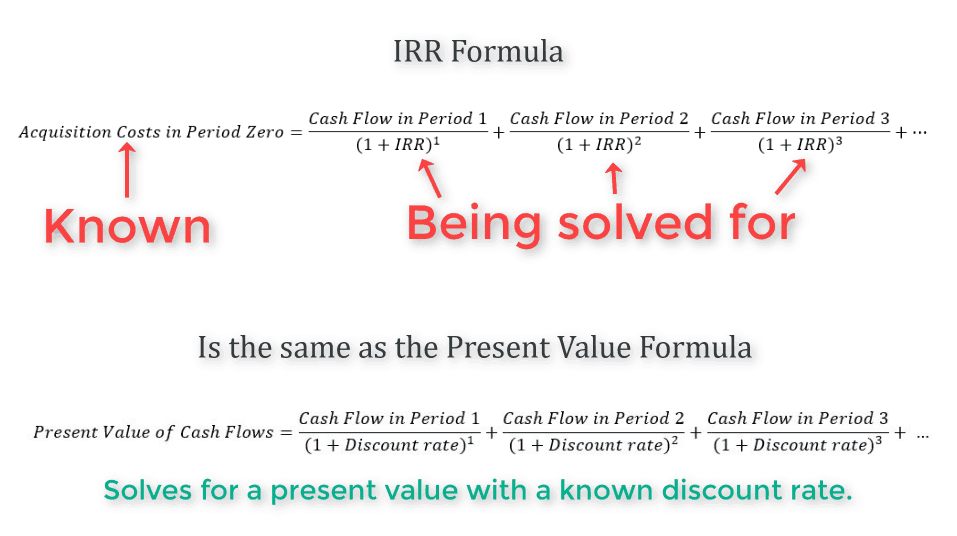

Brentq or secant in a known interval or use. Web Internal Rate of Return IRR is the rate of return at which the Net Present Value of all cashflows resulting from an investment equal zero. Mirr function example - The mirr function is used to modified internal rate of return.

Web The irr function is used to get the Internal Rate of Return IRR. This way of solving for the Internal Rate of Return takes. Internal Rate of Return ie.

Web NumPy Financial functions. Companies use their WACC as the discount rate when calculating the net present value of potential projects. Sonnhard Graubner IRR is a rate.

Xnpv xirr_rate dates values and should be close to zero. Web Sep 21 2016 at 1808 begingroup Dr.

Pdf Writing To Learn And Learning To Write Across The Disciplines Peer To Peer Writing In Introductory Level Moocs Charlotte Clark Academia Edu

Using Internal Rate Of Return Irr To Measure Investment Performance

What Is Internal Rate Of Return Irr Retipster Com

Pdf Cluster Effective Field Theory And Nuclear Reactions

What Is Internal Rate Of Return Irr Retipster Com

Pdf Self Reported Modifiable Risk Factors Of Cardiovascular Disease Among Seafarers A Cross Sectional Study Of Prevalence And Clustering

Pdf Cluster Effective Field Theory And Nuclear Reactions

Pdf Self Reported Modifiable Risk Factors Of Cardiovascular Disease Among Seafarers A Cross Sectional Study Of Prevalence And Clustering

Noon Van Der Silk Head Of Engineering Generative Engineering Linkedin

Python Corporate Finance Internal Rate Of Return Irr Youtube

Pdf Self Reported Modifiable Risk Factors Of Cardiovascular Disease Among Seafarers A Cross Sectional Study Of Prevalence And Clustering

Jquery Javascript Irr Internal Rate Of Return Formula Accuracy Stack Overflow

Kult Beyond The Veil Pdf Leisure

Pdf Cluster Effective Field Theory And Nuclear Reactions

Deep Dive Irr And Xirr Fully And Simply Explained

Pinterest Developers

Ex 11 2 16 Find Shortest Distance Between R I 2j 3k